- Best payroll software for mac manual#

- Best payroll software for mac full#

- Best payroll software for mac software#

Timely and accurate employee payment is critical to any business of any size.

Best payroll software for mac software#

Once the initial information is input into the system, payroll software can automatically calculate figures and log them in the appropriate accounts, reducing errors. Increase Accuracy and Minimize Errors: Payroll software can assure your business accurately withholds taxes for employees and pays into mandatory fees such as Worker’s Compensation.

Cloud-based payroll software systems have been proven to save time by automating tasks.

Best payroll software for mac manual#

Automate Tasks: Manual payroll systems are incredibly time consuming.The following benefits can remove the frustration caused by using an outdated, manual payroll method: Improved staff retention through the execution of compensation packages that reward employee performance.Easier observance of governmental requirements for payroll tax filing and remittance.

Best payroll software for mac full#

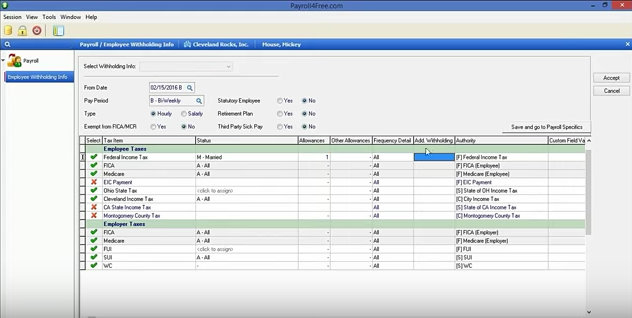

Certified payroll: Ensures third party party verification of wage payments and confirms that wages are in accordance with prevailing wage standardsĬritical business benefits of using effective full payroll software include:.Direct deposit: Allow for automatic deposit of payroll funds to employee bank accounts.Time tracking: Allow employees to report time (either in real-time or after-the-fact) for wage calculation purposes.Employee self-service payroll portal: Allow staff to check on paycheck data such as withholding settings, vacation accrued, tax forms, as well as enact changes without additional administrative support.Electronic payroll tax filing: Allow for the digital submission of direct deposit payroll returns without requiring paper-based submissions.Overtime management: Pay overtime at alternate pay rates or allow for the accrual of vacation time based on overtime worked.Multiple state tax tables: Calculate varying tax rates based on individual state requirements.Deductions management: Allows for custom control over withholding funds from paychecks to cover taxes, benefits, garnishments, health insurance, retirement contributions, etc.Paystubs: Provides detailed paycheck information covering items such as hours worked, salary/wage earned, deductions, tax withholdings, etc.Batch printing can offer efficiencies versus writing individual payroll checks Check printing: Print physical employee paychecks for distribution and tax filing records.

Payroll software remains the key financial focus of all HR software packages, and a necessary tool for payroll departments, or more broadly, human resources.įull service payroll software calculates and tracks employee salaries, wages, bonuses, tax withholding, and deductions. Payroll software is designed to manage all elements of executing employee compensation, including wage calculation, check printing or direct deposit, and payroll tax management.

0 kommentar(er)

0 kommentar(er)